Cash dividends are payments companies make to their shareholders, usually on the strength of earnings. Dividends represent an opportunity for companies to share the benefit of business profits. Learn more about cash dividends below.

From the Latin "dividendum" meaning a "thing to be divided," a dividend is a distribution of profits made by a corporation to its shareholders.

Cash dividends are declared by a corporation's Board of Directors, and are paid to shareholders on a per share basis. Companies usually pay dividends on a fixed schedule, such as quarterly, semi-annually, or yearly. Occasionally some companies will pay what's called a special dividend, in addition to, or in replacement of regular dividends.

In the U.S. and Canada, quarterly dividends are common, while in Australia and Japan, semi-annual dividends are typical, and in Germany, annual dividends are the norm. At any time, a company can declare a special dividend to reflect a non-recurring distribution, such as proceeds from the sale of a major asset.

Cash dividends are typically credited to investors' brokerage accounts where the stock holding resides. Although it is much less common, investors who hold shares directly, and not through an investment account, may be issued paper cheques for the dividend amount they are entitled to.

Preferred shareholders also receive cash dividends in the same manner as common shareholders do. The main difference is that preferred dividends are often fixed at a rate stipulated in the security's prospectus. Some preferred dividends are floating rate, however.

Factoid: The first dividends were offered by the storied Dutch East India Company which, between the years 1602 and 1800, paid an annual dividend of approximately 18 percent of the value of its shares.

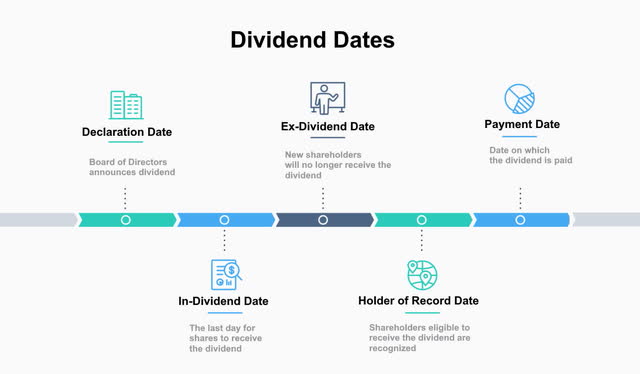

Cash dividends paid by public companies abide by a process stipulated by regulatory organizations. The following dates define the dividend process.

Declaration Date : This is the date an upcoming dividend payment is announced. A liability then appears on the company's balance sheet.

Record Date : This is the market day on which the company will check their records to see who is eligible to receive the dividend.

Ex-Dividend Date : The Ex-Dividend date is normally 1 business day prior to the record date, and at this point trading in the stock reflects the remaining company value after the dividend is paid. Any investor purchasing a stock on the ex-dividend date (or later) will not qualify for receipt of the dividend. Investors must purchase stock before the ex-dividend date to be eligible to receive the dividend.

Payment Date : This is the date on which eligible shareholders can expect to receive the dividend in their accounts. Shareholders' brokerage accounts will be credited on this date. The Payment Date could be several weeks after the record date.

Tip: Stock transactions do not settle for ownership purposes until two days after a trade (T+2). Thus, investors who purchase shares of stock on a Monday don't actually become a shareholder of record until Wednesday. If the record date for this dividend was on the same Tuesday, the investor would not be eligible to receive that dividend even though they bought the shares on Monday.

A substantial number of public companies pay dividends, though not all. Young, growing companies typically don't pay dividends because they are focused on continually investing their profits back into the company. Dividends are therefore most common among larger, more established companies that are generating sufficient profits to distribute some to shareholders. Most large-cap companies included in the S&P 500 index pay regular dividends.

Companies that decide to pay dividends usually expect to continue the practice on an ongoing basis. Some companies may reduce or even suspend their dividends during periods when profits are low, as was the case during the Great Recession of 2008 and 2009. Shareholders tend to place higher value in companies that pay dividends consistently and particularly favor those who increase their dividends over time. For many investors, dividends can be a steady source of income, rivaling that of fixed income investments.

Tip: It is important to remember that cash dividends represent assets leaving a company and going to its shareholders. A company's total cash assets will decline when a dividend is paid. Investors can see record of cash dividends exiting a corporation within the Cash Flow From Financing Activities section of the Cash Flow Statement.

Companies declare cash dividends on a per share basis, making the dividend calculation for a specific shareholder quite simple.

For example, if a company pays a quarterly dividend of $0.50 per share and a shareholder owns 1000 shares, the total cash amount of the quarterly dividend would be:

Investors often measure the dividend appeal of a certain investment security is via the dividend yield. Dividend yields are expressed as a %, and reflect the annual dividend value relative to the latest share price.

Dividend yield (%)= (Current dividend)/(current stock price) x (# of dividends paid in one year)

For example, if a company pays a $1.00 dividend per quarter and has a recent stock price of $80, the dividend yield will be:

Dividend yield = ($1.00/$80.00) X 4 = 5.0%

Using the dividend yield, shareholders can easily assess the dividend appeal of various companies, or even stocks versus selected fixed income instruments.

Tip: When considering stocks based on their dividend yield, it's a good idea to examine company financials to assess a company's ability to sustain or grow dividends at the current rate and whether there are prospects for share price appreciation in addition to dividend income. Some companies paying a high dividend yield may reduce or stop paying a dividend entirely.

Some companies will pay stock dividends instead of cash dividends. In other cases, investors can subscribe to a Dividend Reinvestment Plan (DRIP) which allow them to request that dividends be paid in shares as opposed to cash. DRIPs can be administered by the underlying company, or by an investors' broker.

As with cash dividends, stock dividends must be approved by the company's Directors and announced publicly.

While a stock dividend is not taxable until the shares are sold, a cash dividend is considered taxable income when paid and is subject to ordinary income tax rates. However, cash dividends that are deemed "qualified" by IRS definitions are eligible for lower long-term tax rates.

Dividend taxation in other countries may be subject to substantially different policies. For example, Canadian investors may be eligible for a dividend tax credit that offsets the tax payable on dividends earned.

Cash dividends appeal to many companies as well as investors. They are a benefit to many investors who enjoy having part of their investment returns in cash, or are using dividends as a source of ongoing income. For companies, cash dividend payments tend to attract longer term and institutional investors, which often leads to greater stability of the share price.

It is important to remember that there are no guarantees that dividend-paying companies will not reduce dividends or eliminate them entirely. Banks famously slashed or eliminated their dividends during the global financial crisis, while many energy companies did the same during periods where oil and natural gas prices were extremely low. Investors should carefully assess the potential risks of any investment they make, including dividend-yielding companies.

This article was written by